Select Flow-Through Limited Partnership 2016

Fund Overview

Gravitas Select Flow-Through Limited Partnership 2016 (“The Fund”) invests in flow-through shares of public and private resource companies engaged in:

- Oil and gas exploration, development and/or production

- Mineral exploration, development and/or production

- Renewable energy exploration, development and related resource issuers such as pipeline, utilities and service companies

Gravitas Select Flow-Through Limited Partnership 2016

| Company (June 30, 2017) | Symbol | Focus | % of Portfolio Net of Cash |

|---|---|---|---|

| 1885683 Alberta Ltd | Gold | ||

| Altitude Resources | ALI | Met Coal | 3.4% |

| Alto Ventures | ATV | Gold | 0.9% |

| Alto Ventures | ATV | Gold | 17.3% |

| Ascot Resources | AOT | Gold | 11% |

| Bold Ventures | BOL | Mixed Industrial Metals | 10.3% |

| Braveheart Resources | BHT | Silver, Gold | 6.5% |

| Canada Zinc Metals | CZX | Zinc | 5.1% |

| Cash and Other | Cash and Other | 0.1% | |

| Dolly Varden Silver | DV | Silver, Gold | 4.4% |

| Forum Uranium | FDC | Uranium | 12.3% |

| Nicola Mining | NIM | Copper | 4.9% |

| Pine Point Mining | ZINC | Zinc, Lead | 0.7% |

| Treasury Metals | TML | Gold | 10% |

| West Red Lake Gold | RLG | Gold | 13.1% |

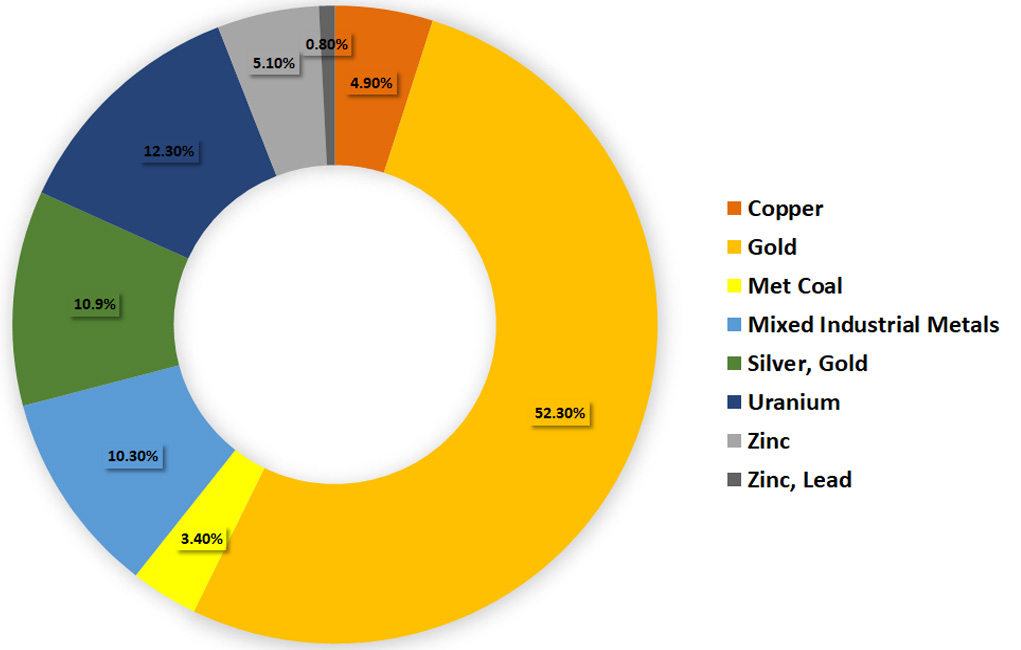

| Commodity Concentration | % of Portfolio |

|---|---|

| Copper | 4.9% |

| Gold | 52.3% |

| Met Coal | 3.4% |

| Mixed Industrial Metals | 10.3% |

| Silver, Gold | 10.9% |

| Uranium | 12.3% |

| Zinc | 5.1% |

| Zinc, Lead | 0.8% |

| Grand Total | 100% |

Investment Objectives

The investment objectives of the Fund are to provide investors with:

- Significant tax benefits potentially of 100%+ of their original investment

- The potential for capital appreciation through investments in the Canadian resources and associated industries.

Investment Highlights

The Fund invests primarily in a spectrum of growth-oriented small to mid-size resource companies listed on the TSX, TSX-V and CSE with the following characteristics:

- Strong growth strategies and prospects

- Experienced, reputable management teams

- Quality projects with a defined business plan

- Attractive valuations/low premiums

Fund Details

Status: Closed for new purchases

Structure: Diversified resource limited partnership flow through

Risk Rating: High

Tax Deductions: 100% of initial investment

Liquidity: Liquidity will be provided by the end of 2019.

Optimal Hold Period: 3 – 5 years

Management Fee: 2%

Fund Code: FIQ101

Min. Investment: $5,000

Eligibility: Units are suitable for taxable accounts only until end of lock-in period (Q4 2019)

Fund Manager

The Manager

Gravitas Securities Inc., together with its affiliates, is a Canadian-based global investment manager founded in 2006. The Gravitas Group of Companies and its subsidiaries manage approximately $4 billion in assets on behalf of more than 30,000 clients across Canada.

Investment Team

The Fund’s investment team is led by Neil Gilday, CIO and Portfolio Manager. Neil and his team have a team based approach to investing and have decades of experience in managing, sourcing and structuring private and public resource transactions.