Special Situations Fund (Trust)

Fund Overview

This fund provides opportunistic, managed exposure to early stage companies operating in some of today’s most exciting investment themes, while retaining a bias to resource oriented stocks. The Fund provides growth potential, useful for adding alpha within the context of a balanced portfolio. Holdings are micro-to-mid-cap companies listed on the TSX, TSX-V and CSE.

Documents

![]() OFFERING MEMORANDUM – Special Situations Fund Trust

OFFERING MEMORANDUM – Special Situations Fund Trust

![]() OVERVIEW – Special Situations Fund Trust ENG

OVERVIEW – Special Situations Fund Trust ENG

![]() OVERVIEW – Special Situations Fund Trust CHINESE

OVERVIEW – Special Situations Fund Trust CHINESE

![]() SUBSCRIPTION AGMT – Special Situations Fund Trust

SUBSCRIPTION AGMT – Special Situations Fund Trust

Special Situations Fund (Trust)

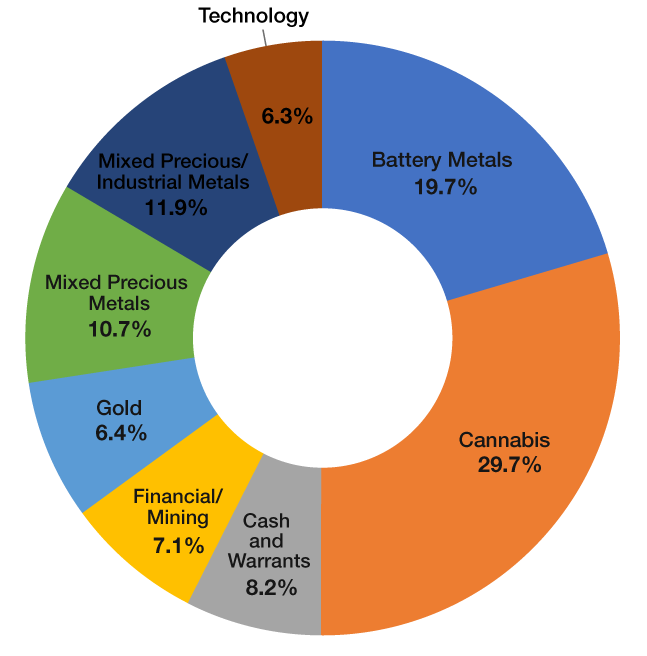

| Equity Holdings | Symbol | Theme | % of Portfolio – Gross of Cash |

|---|---|---|---|

| Aurcana Corp. | AUNFF | Mixed Precious Metals | 10.7% |

| CellCube Energy Storage | CUBE | Battery Metals | 6.3% |

| Deer Horn Capital | Pref 6Ap19 | Financial / Mining | 7.1% |

| E3 Metals Corp | ETMC | Battery Metals | 6.8% |

| First Vanadium Corp. | FVAN | Battery Metals | 6.6% |

| Franchise Cannabis Corp. | AT | Cannabis | 0.0% |

| Int’l Cannabrands Inc. | OIL | Cannabis | 29.7% |

| Jiulian Resources Inc. | JLR | Mixed Precious / Industrial Metals | 11.9% |

| Mexican Gold Corp | Pref 23MAR19 | Gold | 6.4% |

| Wavefront Technology | WEE | Technology | 6.3% |

| Cash and Warrants | Cash and Other | 8.2% | |

| 100% |

Commodity Concentration

Investment Objectives

The fund seeks capital appreciation.

Investment Highlights

The Fund invests primarily in a spectrum of growth-oriented micro-cap to mid-size companies listed on the TSX, TSX-V and CSE with the following characteristics:

- Strong growth strategies and prospects

- Experienced, reputable management teams

- Quality projects with a defined business plan

Fund Details

Structure: Open ended Mutual Fund Trust

Investment type: Units of the structure

Risk Rating: High

Eligibility: Suitable for taxable accounts of accredited and eligible investors of applicable provinces, as defined in the Offering Memorandum. Available to residents of British Columbia, Alberta, Saskatchewan, Manitoba, Quebec and Ontario. Via Trust structure, the fund will be available for RRSP and other tax sheltered plans

Initial price: $10 per unit

Minimum investment: $5,000 per prior arrangement

Maximum: The fund will be closed to new subscribers at $25 million

Redemption Restrictions: Purchasers are restricted to a 1-year initial holding period. Annual redemptions require 90-days notice prior to year-end. Please see Offering Memorandum.

Classes available: A and F

Fund Code: FIQ121 (class A) / FIQ123 (class F)

Sales: Subscription agreement

Commission: TBD

Management fees: 2% (class A) / 1% (class F). A 20% performance fee will be paid on all net returns over 5% per annum.

Management expenses:0.75%

Manager: Gravitas Securities Inc.

Fund Manager

The Manager

Gravitas Securities Inc., together with its affiliates, is a Canadian-based global investment manager founded in 2006. The Gravitas Group of Companies has over C$3.6 billion in assets under administration and includes more than 400 investment professionals located across North America.

Investment Team

The Fund’s investment team is led by Neil Gilday, CEO of Gravitas Investments and Portfolio Manager of Gravitas Securities Inc.

Neil and his team have a team based approach to investing and have decades of experience in managing, sourcing and structuring private and public resource transactions.

Neil Gilday, CFA

Portfolio Manager

Gravitas Securities Inc.

Graham Shirley, CFA

Investment Advisor

Gravitas Securities Inc.

Wes Roberts, B.Sc., MBA, P.Eng.

Analyst, Mining